As an overworked, overtired, and underfed university student, we know how it works. After weeks of toil on Jora Local, you finally find an employer. You do your trial shift to a resounding success, and you get the job. Here comes the paperwork. With haste, you fill out the tax file declaration, you submit your banking details and without a second thought, you speed through the superannuation choice form, ticking the box to let your employer nominate a fund for you. What’s the worst that can happen in that regard?

Frankly, quite a lot. In the litany of educational failures in Australia, superannuation was – at best – a brief footnote in your high school career. It is not your fault that you have no idea how super works, or the effect that it has on your future and the future of the planet. However, it is important that if you want to be considered an informed citizen and economic actor, you need to know where your money is going and who it is supporting.

Superannuation is effectively an investment portfolio, where around 10 percent of your yearly salary goes into. By the time you reach retirement, you can use your superannuation to subsidise your living expenses and not rely too heavily on a government provided pension. Over the course of your entire career, your super account will generate cash that will provide the income you need when you no longer work. This is done by putting that money into stocks and other assets, which the super fund (a company that looks after your superannuation) manages for you.

Your money increases in value through several ways. The main way your money appreciates is through businesses you invested in becoming larger. When you have money in a company, and that company is doing well – increasing clientele, expanding operations, and making products more efficiently – its value increases. This means that in retirement, the value of the stock is much greater than when you bought it, thus achieving you a return (assuming all goes well). The second way is through dividends, which is a sum of cash a company pays you out of its profits for being a shareholder. All of this is facilitated by your super fund.

Here is where the problems begin. There are many superfunds, who all have different investing strategies. The first problem is a question of returns. When you let employers choose your superfund; they may be placing you in a fund with below-average returns when compared to better superfunds. This can have a devastating long-term impact and lose you hundreds of thousands of dollars. Similarly, high management fees charged by superfunds can cut returns significantly, especially at the start of your career where every dollar invested can go far.

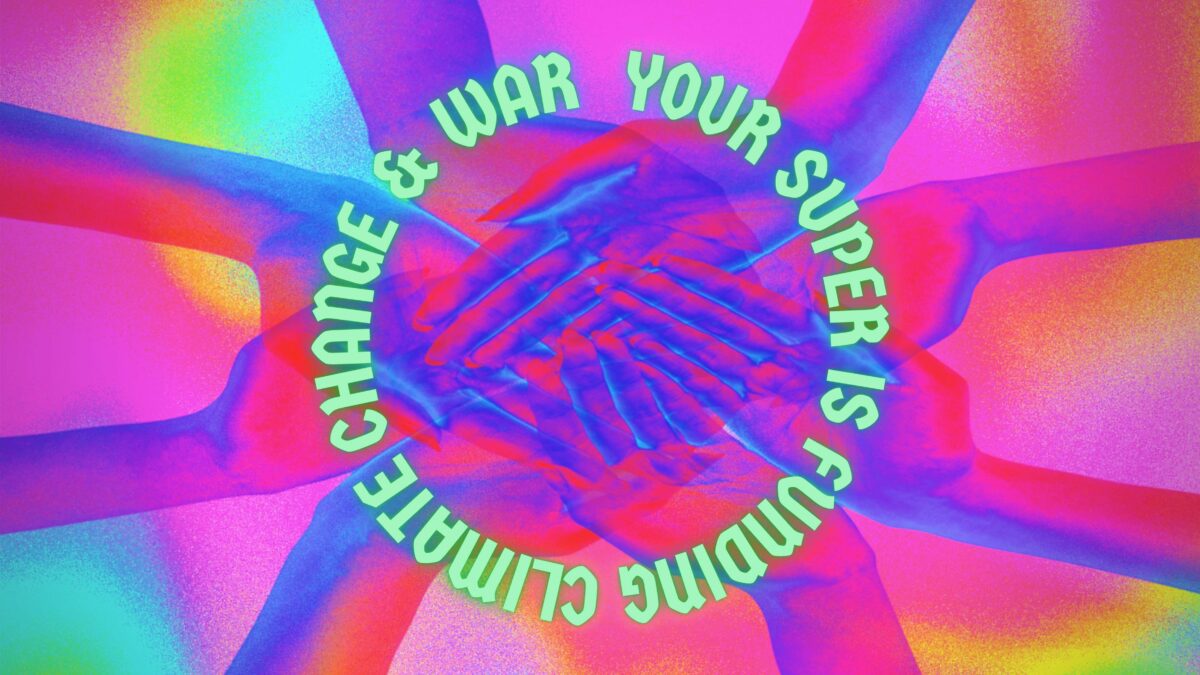

The second problem is a lot more complex and depending on your moral compass, it can be incredibly alarming. Since superfunds mainly make returns by investing in corporations, they may be using your money to support and fund ethically dubious businesses. For instance, a lot of superfunds in Australia invest in fossil fuel corporations such as BHP or Woodside Petroleum.

Over the course of your professional life, it is likely you’ll have a super account in excess of $500,000. Imagine if you didn’t pay much attention to your super, and the fund you are with is investing your income into fossil fuels. Your money, against your knowledge, is directly supporting a climate disaster – and it will be a noticeable sum of money as well, as it accrues interest and value over your whole lifetime.

It doesn’t stop at supporting global warming. Your money may be invested in all sorts of moral evils – neo-colonialism, warfare, or drugs. For instance, imagine your superfund has money invested in Raytheon Technologies or Northrop Grumman, two very profitable companies which specialise in building weapons. Only this year, Amnesty International have reported that the Saudi Arabian monarchy have used bombs built by these companies to commit wholesale atrocities in Yemen. Are these really the corporations you wish to be supporting? Or imagine that your money is in companies such as Amazon or Apple, who have absolutely pitiful working conditions in the USA. Let alone less economically developed countries such as China, where labourers work for cents on the hour. Rather than choosing a superfund that puts your money into businesses which try and produce a social good, such as renewables companies, your money is going straight into the hands of corporate giants who would do anything to increase their bottom line.

You are not powerless against this. In fact, it is quite easy to change superfunds and investment allocations, as well as moving your entire super contributions to a better fund. Depending on what you find morally reprehensible, there are funds who cater to your wants. For example, if you are particularly concerned about climate change, funds such as HESTA or Australian Ethical focus on investing in companies which are making meaningful strides to a net zero future. Similarly, superfunds such as Aware Super are keen on pacifism (not investing in the two heinous companies mentioned before, for example) and having no tobacco stocks. Hopefully with this newfound knowledge, you can find a superfund who can address your concerns properly, whether it be low returns, moral regard, or high management fees.

All it takes is a little research. Next time you realise that you are filling out the haunted Standard Superannuation Choice Form, stop for a moment. Remember to think about how your money is going to be spent. Take the time to invest in yourself and invest in the planet.

Disclaimer: This article only expresses the views of the author and should not be considered financial advice. It is important to do your own research and seek independent professional advice. Woroni shall have no liability for any damage or loss suffered from reliance on information published by us.

hink your name would look good in print? Woroni is always open for submissions. Email write@woroni.com.au with a pitch or draft. You can find more info on submitting here.

We acknowledge the Ngunnawal and Ngambri people, who are the Traditional Custodians of the land on which Woroni, Woroni Radio and Woroni TV are created, edited, published, printed and distributed. We pay our respects to Elders past and present. We acknowledge that the name Woroni was taken from the Wadi Wadi Nation without permission, and we are striving to do better for future reconciliation.