It is now 17 months since ANU’s announcement of its Below Zero campaign, and a year since the second ANUSA fossil fuel divestment referendum (and eight years since the first). This article summarises where the ANU is up to, and why it is so hard to pin down what net-zero and divestment really mean.

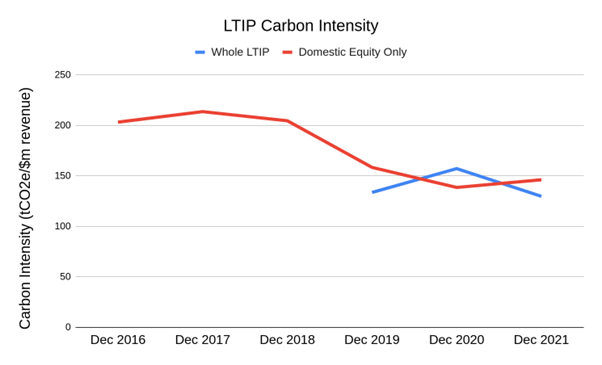

The Australian National University’s net-zero goal is well placed and ambitious for the aspects it covers, and not for the things it doesn’t cover. The University’s Long Term Investment Pool remains exposed to greenhouse gas emissions and has had its carbon intensity decrease only 25 percent in the last five years. There still remains no firm commitment to divestment despite student and staff calls over the last decade. This places the University apart from peers like Cambridge, Stanford, and Harvard who have plans for net-zero in their investment portfolios over various timespans.

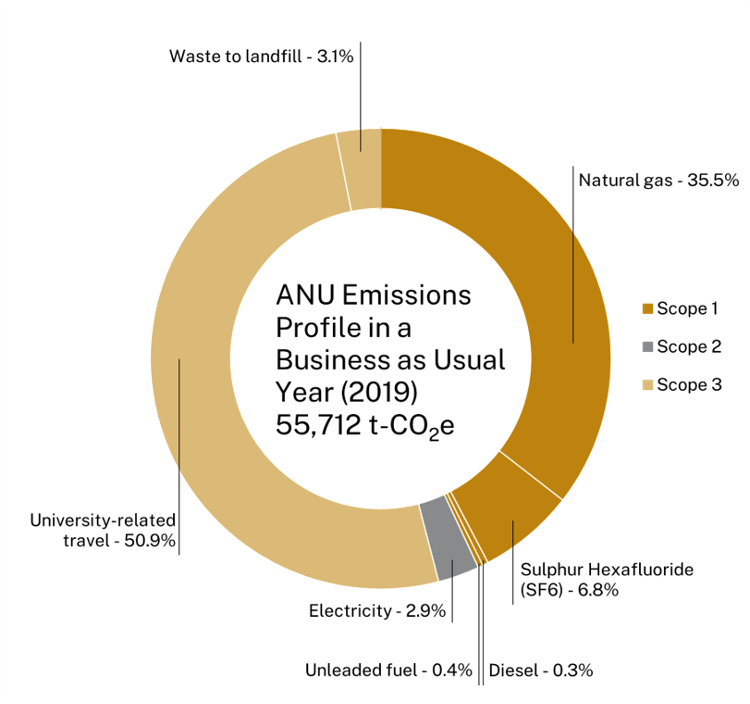

The Below-Zero team baselined the typical year emissions from ANU in some areas, with the vast majority of emissions coming from work travel (excluding commuting), and a significant quantity from natural gas. They estimate that work travel emissions are likely three to four times larger than ANU’s data set records.

ANU’s Current Goals and Policies

At time of publication, the ANU has made the following goals on climate change:

- Net-zero by 2025 for direct on-campus activities, energy, business travel and waste.

- Below-zero emissions by 2030 for direct on-campus activities, energy, business travel and waste.

- Not investing in companies which draw more than 20 percent of revenue from coal.

- Having ANU’s Domestic Equity portfolio be at least 25 percentlower in carbon intensity than the ASX 200 benchmark.

- By Council resolution, a target of 75 percent less carbon in the overseas equities portfolio relative to the benchmark.

The first two goals are part of ANU’s Below Zero initiative, which has an enthusiastic and committed team who sat down to speak with Woroni as they begin to move into “more of an implementation phase.”

When asked what they were most excited about, they highlighted plans to “work with Traditional Owners and understand their vision for healthy Country on ANU manages land, or how [ANU] might support Traditional Owners to enact their vision for healthy Country on First nations managed lands.” They aim to do this through policies like provision of resources; involving the community and creating a sense of ownership over the impact for all; and “embedding this deeply in the way ANU functions, makes decision, prioritises, governs itself.”

For specific early policies, the Below Zero team stated that “we are starting to get some specific buildings that are moving from gas to electrical heat pumps,” implementing “guidelines and approaches… around travel,” and that they have created “a set of principles” for carbon removal.

The Below Zero team emphasised both the individual and institutional levels of emissions reduction. The fact that most of the University’s emissions come from non-commuter work travel means that staff need to engage individually with the travel arrangements that they book. While the ANU itself moves, for example, to electrify its buildings. The Below Zero team described it as a “synergistic” approach involving both policy and individual staff commitments.

It should be noted that these targets do not include ANU’s investments and commuter travel. The Below Zero team agreed with Woroni that the exclusion of ANU’s investment portfolio was an “elephant in the room” however, they justified the current exclusion through the long-standing Socially Responsible Investment Policy for which there are already “a lot of structures in place at ANU…including committees and boards on work towards divesting from fossil fuels,” so it “didn’t make a lot of sense” to reconstruct those efforts in the context of Below Zero. A member of Below Zero however said that going forward in “an ambitious and forward leaning commitment, we’re going to have to think about expanding what we are currently looking after,” and that “investment is one of those things which is front of mind.”

This is primarily referring to ANU’s Long Term Investment Pool (LTIP) which includes shares in some companies which lead to the emission of significant quantities of greenhouse gases, although the exact breakdown is unavailable. At the end of 2021, the LTIP was worth $1.4 billion, containing an array of domestic and international equity, fixed interest products, infrastructure, cash, and other investments.

The divestment question has always been contentious, with the campaign for ANU to divest beginning in 2011, back when Woroni looked like this:

It continues to this day, with last year’s student referendum delivering a resounding ‘yes’ for divestment.

As it presently stands, ANU has partially divested from fossil fuels and continues to decrease its investment in fossil fuels at a rate of around 25 percent over the last half-decade. The University does not have a public goal on further divestment, excluding a February 2022 resolution of the ANU Council to set “a target of 75 percent less carbon intensity in the overseas equities portfolio relative to the benchmark,” which was already 77.5 percent below the benchmark as of 2021.

After passing its Socially Responsible Investment (SRI) Policy in 2013, the University sold off $16 million in shares from companies like Newcrest Mining, Iluka Resources, Oil Search and Santos in 2014 due to assessed social harm. Then after switching to an external portfolio manager in 2015, carbon intensity limits were created at 25 percent below that of the ASX 200 index, which is based on the 200 largest stocks on the Australian Securities Exchange.

Each year ANU releases a Socially Responsible Investment (SRI) report which outlines the LTIP’s carbon intensity, among other ethics goals. From 2019, this is aggregated across the entire portfolio as well as by investment type and expressed in CO2 equivalent produced by revenue. The graph below shows that from 2016, the carbon intensity from ANU’s domestic equity holdings has decreased 25 percent. It is currently at 32 percent less carbon intensity than the S&P ASX200.

ANU does not have a public target to reach zero carbon intensity, or offset emissions from investment. This means that, overall, the ANU is committed to below zero emissions while it avoids accountable commitments to further divestment.

The Difficulties of Carbon Accounting

For an organisation to be net or below zero, it means that the amount they are emitting is at most equal to the amount they are offsetting or sequestering. However, organisations may choose to count or exclude particular sources from its accounting and goals.

This makes it difficult to compare the pledges of organisations, and difficult to hold them accountable. Luckily there is a corporate standard for accounting and reporting greenhouse gas emissions.

Under the standard, emissions are defined into three scopes, with the first covering direct emissions like those caused by company vehicles and leaking refrigerant gases, the second being indirect owned emissions like the consumption of electricity, and the third being all other indirect emissions like greenhouse gases from waste, investments, business travel and employee commutes.

Using this, what does ANU’s goal account for? The goals from the Below-Zero campaign correspond to all of scope two2, and some of scope 3, with the notable exclusion of ANU’s investment portfolio and commuter travel.

On the other side are the sources from which emissions are offset, with the primary ones being sequestration and credits.

Carbon sequestration involves capturing CO2 from the atmosphere to neutralise its contribution to global warming. This often looks like tree planting, but there are sequestration methods which create building materials, and potential techniques being developed at ANU to create concrete which traps C02. ANU has not announced any carbon sequestration projects, but heralds it as a key mechanism for its goals.

Carbon credit systems are controversial, and also part of ANU’s strategy as a “back up [sic]” of indeterminate size where the primary methods of emissions reduction are insufficient. Australian carbon credit units (ACCUs) are issued when a tonne of carbon dioxide equivalent is stored or avoided, and these are purchased either to keep below legal limits on scope 1 emissions or voluntarily. ANU Media recently published an article which outlined that “the available data suggests 70 to 80 percent of the ACCUs issued to these projects are devoid of integrity – they do not represent real and additional abatement,” and included the statement from Professor Andrew Macintosh that “Australia’s Emissions Reduction Fund (ERF) has serious governance flaws and is potentially wasting billions of dollars in taxpayers’ money.” In a conversation with Woroni, the Below Zero team told us that this is something they care about deeply, and that they are taking the situation seriously to ensure that ANU is being responsible in its purchase of carbon credits. Further, an ANU spokesperson told Woroni that in collaboration between academic, professional staff, and higher-degree research students, “In July 2022, ANU Council adopted the ANU Principles for Carbon Removal… [which] set the standards that will drive both commercial carbon credit purchases (pre-2030) and ANU-connected projects.”

There is optimism around the push to net-zero by 2025, but ANU’s goals for divestment continue to lag behind this. But how does this compare to other comparable universities? Stay tuned for a follow-up article in which we contrast ANU’s commitments to those of the universities to which it compares itself.

Readers interested in participating in Below Zero can find more information on the Below Zero website and contact the team at belowzero@anu.edu.au

We acknowledge the Ngunnawal and Ngambri people, who are the Traditional Custodians of the land on which Woroni, Woroni Radio and Woroni TV are created, edited, published, printed and distributed. We pay our respects to Elders past and present. We acknowledge that the name Woroni was taken from the Wadi Wadi Nation without permission, and we are striving to do better for future reconciliation.